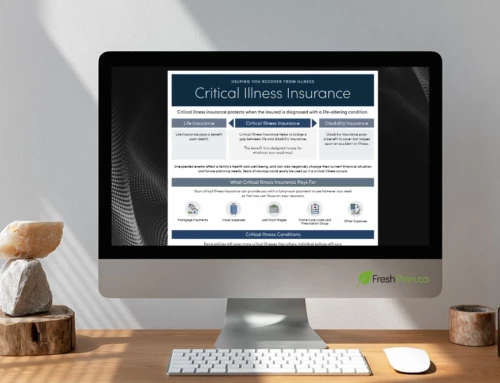

Taxes and Investment Income Infographic

It is important to consider taxes and investment income, as the type of income produced by the investments in your portfolio affects how much tax you pay on that income.

Generally, your investment will fall into the common categories of income, dividends, and capital gains. These income types are taxed differently by the Canada Revenue Agency.

Consider your after-tax returns

Income producing investments like T-Bills, GICs and bonds are taxed at a different rate than dividends. Capital gains are also taxed at a different rate.

This taxes and investment income infographic illustrates various investments that produce different types of income and the impact taxation (depending on your marginal rate) has on what you keep as an investor.

“How much investment income that you keep is important.”

Companion Calculator

Try the FreshPlan Taxes and Investment Income calculator to see how various types of investment income are taxed at different rates.

Infographic Features

- Communicate complex concepts with vibrant, sharable, easy-to-understand infographics

- Personalized for individual Advisors

- Current and timely for client communications

- One of many infographics included in FreshPlan software

Calculate. Educate. Plan.

Communicate complex concepts from all areas of financial planning with current, visual infographics.

FreshPlan combines 75 calculators with powerful infographics and planners to provide advisors with a visual, easy-to-use, time saving planning and education tool and can be accessed anywhere, anytime using any device – phone, tablet, iPad, laptop or desktop.